Discovering a really perfect steadiness between risk appetite and potential earnings, to reinforce working capital, and measure performance in a quick-moving digitised environment is the place Deloitte credit score administration makes an influence that issues. These one-dimension-matches-all credit score info options fall brief, nevertheless, in terms of offering the trade-particular data credit score managers need to round out a customer’s financial profile and cost historical past. NACM is committed to assisting every member, meeting their wants and addressing their considerations by providing simple-to-obtain, excessive-high quality products, services and packages.

The matter of cross-subsidization has been an intentional enterprise choice by the administration of the institutions. Cerved Credit Administration’s expertise ensures speedy and sturdy assessment of individual loans and full portfolios, with correct estimates of anticipated recovery and re-entry instances.

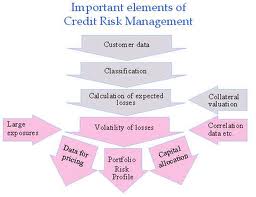

The final word purpose is to take credit score management to a more strategic degree and facilitate interaction with different functions. Credit managers routinely use credit bureau reviews as a supply of knowledge for determining the creditworthiness of a buyer.

It automates portfolio management and improve efficiency and income optimization. Also think about factoring (CRF Credit Assistant – Collateralization / Securitization) or trade credit insurance coverage, and, after all, perfecting a security interest in your customer’s belongings.

By appropriately structuring your sales contract (and/or credit software), you possibly can build future safety in case it’s good to litigate. Help ease the drudgery of guide tasks on your vital credit score administration workforce, and do not let cashflow surprises kill your corporation.