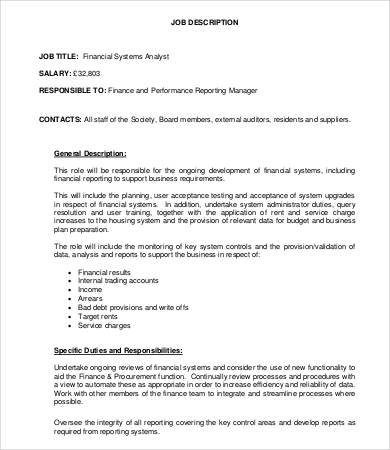

Enterprise Analyst Finance Domain Pattern Resume

If you are a finance main, or have already got a degree in finance, you recognize the significance of a monetary analyst certification. Financial analysts should present a suggestion to purchase, hold, or promote a security. Even within these specialties, there are subspecialties comparable to analysts who focus on equities and people focusing on analyzing mounted-revenue instruments. Scores analysts consider the flexibility of corporations or governments to pay their debts.

Having certifications and a graduate degree can considerably enhance an applicant’s prospects. Financial analysts use mathematical skills when estimating the value of financial securities. In addition, you could receive voluntary certification by way of the CFA Institute, which grants the Chartered Monetary Analyst (CFA) credential, along with the Certificate in Funding Efficiency Measurement (CIPM) designation.

Via intensive analysis of an organization’s sales and expenditures, financial analysts determine an organization’s worth primarily based on future earnings. Portfolio managers supervise a crew of analysts and choose the mix of products, industries, and areas for his or her firm’s funding portfolio.

Financial analysts bear great accountability for the financial performance of an investment or company agency. Financial analysts also typically obtain significant bonuses based mostly on their company’s earnings. The enterprise media rent …