Credit score Administration Vs Money Management

Give your organisation higher control of overdue balances and approaching credit limits in Microsoft Dynamics NAV. Midstate CreditCollect helps businesses to be taught new methods and develop higher credit administration methods, achieving common cash movement and avoiding dangerous debt write-off. Black Fox Credit Administration is proud to be the preferred collections agency for a broad vary of clients starting from regional service suppliers to banks, excessive avenue retailers, worldwide manufacturers and JSE-listed companies.

These massive ticket objects are only out there should you successfully can scale back your debt, keep your cost historical past and enhance your credit score score. In response to Fair Isaac Corporation, any card where your steadiness exceeds thirty {91eeb8b4fd271bd4d1e056c0f6f68647b4f9a693f1217c93a23de392f6e4868f} of your credit score limit will cause a drop in your credit score rating.

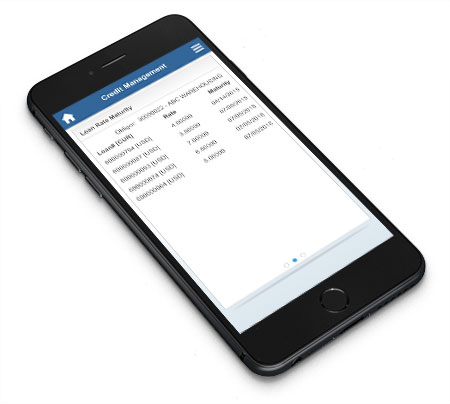

Administration of the account, totally different organisational structures within the credit division. You get insight into your relations’ credit scores and link it to the simplest observe up process. Good individuals and streamlined processes should be supported by the suitable programs.

They will help you with a debt administration plan to reduce your debt and improve your credit score. It presents advanced purposes to satisfy the distinctive needs of Chief Credit score …