Whether you might be in search of full credit management, proactive bill management, efficient credit control or skilled collections specialists, Millmeads are here to help you together with your cash movement. Credit score Administration offers your defined customers particular monetary authorisation limits; enabling gross sales orders to be released as required and/or outline a particular grace interval for overdue balances. The banks are now more equipped in dealing with credit risk, within the allocation of its on-going credit score allocation actions.

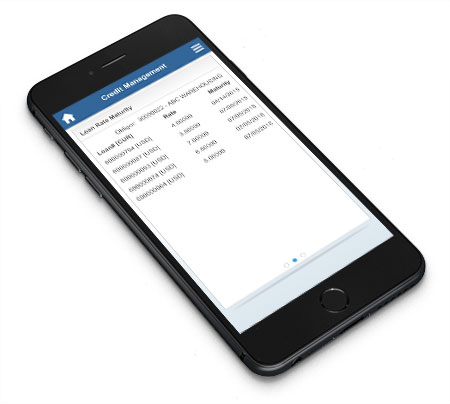

This proves that you’ve got a superb danger administration software program tools in your credit score administration program. Receive credit availability amounts daily, or be notified when loans are set to mature or expire. Detailed examine of insolvency, including the Firms Act, the Agricultural Credit Act and case regulation.

OnGuard is designed to make your credit score & collections administration simple and efficient. A poor credit score rating can have an effect on your automotive insurance coverage premiums, loan rates of interest, and other bills. This evolution of techniques have been vastly supported by the technological advancement made, with low price computing being made obtainable, making analyzing, measuring, and controlling credit score threat in a far better means.

The higher their relationship with creditors, the better a debt management firm’s chances of successfully negotiating for a number of of those concessions. Utilizing an inside and nicely developed monetary danger administration system will monitor the market threat and financial capital.

Its based mostly part can be easily built-in using your danger administration software program tools. First-social gathering assortment outsourcing is nothing to be afraid of. Most credit departments in the present day can’t afford to hire all the staff they require to the touch all of their credit or delinquent accounts.