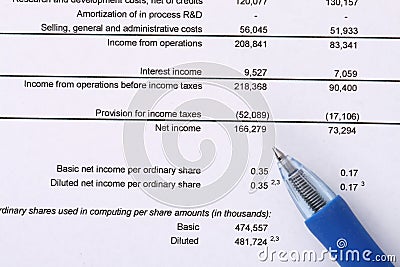

The person who does monetary analysis for external or inner purchasers is called financial analyst. To acquire the info needed to formulate monetary models and supply thorough analysis, analysts evaluate public filings and information and analyze monetary statements particular to the companies below scrutiny. They use the data to guage current and past investment efficiency and forecast future performance, usually utilizing monetary modeling methods.

Analysts which are promoted also study to develop communication and people abilities by crafting written and oral shows that impress senior administration. Some analysts proceed to work the identical jobs for his or her total careers, managing funds or selling trading opportunities on the sell-side.

Financial analysts must course of a spread of knowledge in finding profitable investments. Additionally, the BLS studies that many analysts should take their work home with them, typically to research information and data that can help them on subsequent business days. In these firms, analysts research companies as they look for stocks to add to an funding fund.

Determination-making: A monetary analyst usually serves as the choice-maker in a agency for buying, selling, and holding securities, in addition to serving an organization’s funds. Staying current on market trends also entails spending loads of time reading industry and company profiles, as well as following present occasions intently in financial publications.

Restrictions on trading by banks may shift employment of economic analysts from funding banks to hedge funds and private equity teams. Although credit standing bureaus, corresponding to Fitch Ratings, Normal & Poor’s, or Moody’s, make use of many scores analysts, large institutional buyers additionally rent ratings analysts to do in-home evaluation.